As a small business owner, I just need to take a moment to talk about how horrible Herman Cain's "999" tax plan is.

"999" is catchy phrase that sounds simple. And since my business spends about $45,000 each year just complying with tax law (in order to literally stay out of jail), "simple" would be an improvement.

The problem is, "999" doesn't make my taxes simpler. It actually will cost me a lot more to calculate my taxes, appease the I.R.S., and stay out of jail. The third "9" in "999" is an entirely new national sales tax. Herman Cain wants 9% on top of everything I sell. And it's not a value-added tax, it's a straight sales tax. So, if I buy computer parts for $900 and then sell them computer for $1000, I owe the Cain Administration $90. That's 90% of my margin, before I even pay for other taxes or expenses.

The Christian Science Monitor reports that Cain's plan eliminates the ability to treat labor as a business expense. So let's imagine that my small company earns $500,000 making software, and spends $50,000 on capital (like computers) and $400,000 paying five employees. Under "999", I pay an all-new 9% sales tax on my $500,000 of sales. Then, because I can't deduct the $400,000 of labor cost, I pay a 9% corporate tax on that. As a small business owner, I have to declare corporate "profits" as personal income, so I pay another 9% on the $450,000 that I didn't spend on capital equipment. Finally, my employees have to pay a 9% income tax on the $400,000 that I pay them. And when they spend that $400,000, they pay another 9% for the new national sales tax. So, Cain's "999" plan has added $189,000 in brand new taxes for a company that only sells $500,000 worth of stuff. And all those taxes are in addition to all my other taxes like property taxes, local business taxes, excise taxes and state sales taxes. Herman Cain has single-handedly turned a profitable small business with five employees into a money-losing business; one that will shut its doors and fire everyone within the first year of his presidency.

"999" is a great plan if you want to shut down every small business and force those employees to go work for large corporations or the government. It's the end of small business, and the end of innovation. It's the fastest way I can think of to turn American into a Third World Nation.

Furthermore, "999" is a lie. Rich Lowrie, Cain's Senior Economic Advisor, says that the "this is an attempt to shift the tax burden away from production and towards consumption, to balance the load. This taxes everything once but nothing twice.” As you can see above, if I earn $1,000 in revenue by selling a computer, that $1,000 is taxed multiple times before it ends up in the hands of my employees. And thanks to an all-new national sales tax, that money is taxed again when they spend it.

And the idea that this shifts taxes "away from production and towards consumption" is bullshit. Labor (paying someone to "produce" something) is now taxed three times. But buying capital equipment (consumption) is only taxed once.

As for the national sales tax, once you add another tax, it never goes away. The average American currently loses 44% of their paycheck to taxes. Just using back of the envelope math, it would appear that Mr. Cain's '999' plan would reduce this tax burden to about 27% (9% + 9% + 9%). But he isn't actually reducing taxes. That 44% figure includes property taxes, state income taxes, gasoline taxes, excise taxes, state sales taxes, etc. When all is said and done, it's likely that an average American, earning about $40K per year, will end up losing more than 50% of that to taxes under Cain's plan.

So, he wants to increase taxes on the middle class, and further decrease taxes on the wealthy. In other words, he wants to continue down the path we've been following for the last 30 years of taxing the middle class and transferring it to the top 1%. And in the process, it doesn't simplify the system. In fact, for small business owners like myself, he makes it significantly more complicated, and more costly, to comply with -- something that will undoubtedly lead to more layoffs and more unemployment.

Friday, September 30, 2011

Thursday, August 18, 2011

Honesty

I feel a bit weird talking to a Customer Support person, whom I'm pretty sure is India, but wants me to call him 'Aaron'.

Why does FedEx (and every other company that outsources their phone banks to India) think it's necessary to pretend that I'm talking to someone in Texas?

My experience so far is that the overseas customer support folks are as nice, as knowledgeable, and as well educated as the ones I used to talk to in the U.S.

It makes sense that this would be the case. In the United States, phone support pays worse than fast food. But in India, they've probably got college graduates answering the phones.

My problem is just that I don't like being lied to. My computer monitor was made in China. It's outlandishly affordable and of pretty high quality. So I'm not complaining. So if U.S. companies aren't lying to me about where my computer is manufactured, why do they have to lie to me about who I'm talking to on the phone?

Friday, July 29, 2011

Obama's "Failed Stimulus"

I'm getting sick and tired of everyone referring to Obama's "failed stimulus".

But what really bugs me is that almost no one is bothering to point out that the stimulus actually prevented the Second Great Depression.

The vast majority of economists agree that the economy needed stimulus, funded by deficit-spending.

And they were right.

(In looking at that graph, note that Obama signed the 'Recovery Act' in February of 2009).

I understand that the recovery wasn't as strong as that flouted by Obama's advisers when they were trying to pass the bill. I get it. Either the economists were wrong. Or they over-stated their case in order to get the legislation passed. Just like Colin Powell "over-stated" the evidence for WMDs, and President Bush "over-stated" the need to give $1 trillion to Wall Street in September of 2008 with no strings attached.

If McCain had won, he surely would have signed a large stimulus bill in his first month in office, just like Obama did. And it would have had similar results to the bill Obama signed.

And every Republican would have been touting the brilliant policy signed by President McCain in order to pull us out of the Bush Tailspin. The only reason everyone with an '(R)' next to their name hates the stimulus so much is because it was done on Obama's watch.

(And of course we'd be in better shape now if Bush had signed a similar bill before leaving office, instead of borrowing from the next generation to write a big check to Wall Street).

Even three years after the death of Lehman Brothers, conservative publications like The Economist are still recommending "short-term stimulus and medium-term deficit reduction". In other words, the 2009 stimulus was too small.

Can we step back from the political bickering for a minute to actually think about what's best for the country? The GOP isn't stupid. They know the economy needed stimulus, and still needs stimulus. But they also know that if the unemployment rate stays above 9%, they might beat Obama in 2012. If it wasn't hurting real people, I would applaud the ingenuity of this strategy.

But what really bugs me is that almost no one is bothering to point out that the stimulus actually prevented the Second Great Depression.

The vast majority of economists agree that the economy needed stimulus, funded by deficit-spending.

And they were right.

(In looking at that graph, note that Obama signed the 'Recovery Act' in February of 2009).

I understand that the recovery wasn't as strong as that flouted by Obama's advisers when they were trying to pass the bill. I get it. Either the economists were wrong. Or they over-stated their case in order to get the legislation passed. Just like Colin Powell "over-stated" the evidence for WMDs, and President Bush "over-stated" the need to give $1 trillion to Wall Street in September of 2008 with no strings attached.

If McCain had won, he surely would have signed a large stimulus bill in his first month in office, just like Obama did. And it would have had similar results to the bill Obama signed.

And every Republican would have been touting the brilliant policy signed by President McCain in order to pull us out of the Bush Tailspin. The only reason everyone with an '(R)' next to their name hates the stimulus so much is because it was done on Obama's watch.

(And of course we'd be in better shape now if Bush had signed a similar bill before leaving office, instead of borrowing from the next generation to write a big check to Wall Street).

Even three years after the death of Lehman Brothers, conservative publications like The Economist are still recommending "short-term stimulus and medium-term deficit reduction". In other words, the 2009 stimulus was too small.

Can we step back from the political bickering for a minute to actually think about what's best for the country? The GOP isn't stupid. They know the economy needed stimulus, and still needs stimulus. But they also know that if the unemployment rate stays above 9%, they might beat Obama in 2012. If it wasn't hurting real people, I would applaud the ingenuity of this strategy.

Saturday, July 23, 2011

2011 Offensive Line Rankings

Based on career stats for all active linemen (adjusted for age, and weighted for recent performance and injuries) here are ratings for the current offensive lines for all 32 NFL teams. For individual ratings for each offensive lineman, you can download this year's version of Football Mogul, which is 100% free (no time limits or registration required).

| Rank | Team | Overall | Run Blocking | Pass Blocking | 2010 Rank |

| 1 | New Orleans Saints | 94 | 94 | 94 | 1 |

| 2 | Carolina Panthers | 92.5 | 98 | 87 | 4 |

| 3 | Tennessee Titans | 89 | 85 | 93 | 2 |

| 4 | Minnesota Vikings | 87.5 | 95 | 80 | 10 |

| 5 | New England Patriots | 87 | 82 | 92 | 5 |

| 6 | Baltimore Ravens | 86.5 | 90 | 83 | 7 |

| 7 | Atlanta Falcons | 85.5 | 81 | 90 | 6 |

| 8 | Denver Broncos | 85.5 | 86 | 85 | 14 |

| 9 | Cincinnati Bengals | 85.0 | 79 | 91 | 16 |

| 10 | New York Jets | 84.5 | 84 | 85 | 3 |

| 11 | Buffalo Bills | 84.5 | 89 | 80 | 26 |

| 12 | New York Giants | 84.0 | 79 | 89 | 13 |

| 13 | Houston Texans | 83.5 | 79 | 88 | 20 |

| 14 | San Diego Chargers | 83.5 | 76 | 91 | 19 |

| 15 | Dallas Cowboys | 83.5 | 85 | 82 | 9 |

| 16 | San Francisco 49ers | 83.0 | 85 | 81 | 18 |

| 17 | Philadelphia Eagles | 83.0 | 84 | 82 | 21 |

| 18 | Arizona Cardinals | 82.5 | 81 | 84 | 11 |

| 19 | Green Bay Packers | 82.0 | 86 | 78 | 22 |

| 20 | Detroit Lions | 81.5 | 81 | 82 | 28 |

| 21 | Oakland Raiders | 81.5 | 83 | 80 | 29 |

| 22 | Jacksonville Jaguars | 81.0 | 86 | 76 | 17 |

| 23 | Miami Dolphins | 81.0 | 86 | 76 | 8 |

| 24 | Tampa Bay Buccaneers | 80.5 | 76 | 85 | 25 |

| 25 | Cleveland Browns | 80.0 | 76 | 84 | 15 |

| 26 | Chicago Bears | 79.0 | 77 | 81 | 24 |

| 27 | Pittsburgh Steelers | 78.5 | 83 | 74 | 27 |

| 28 | Kansas City Chiefs | 78.5 | 80 | 77 | 23 |

| 29 | Indianapolis Colts | 77.0 | 74 | 80 | 12 |

| 30 | Seattle Seahawks | 73.0 | 75 | 71 | 30 |

| 31 | Washington Redskins | 73.0 | 76 | 70 | 32 |

| 32 | St. Louis Rams | 72.0 | 76 | 68 | 31 |

Sunday, June 12, 2011

We Are The 53%!

|

| Photo by Gage Skidmore |

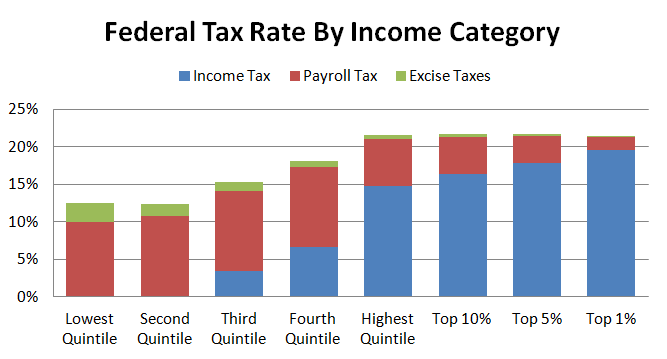

Here are the income tax rates, by income category, provided by the Congressional Budget Office:

Representative Bachmann is right. There are about 140 million Americans on the left side of the graph that aren't paying any taxes. But income taxes aren't the only federal taxes. Almost $900 billion in annual revenue is collected through payroll taxes on each and every paycheck. Another $75 billion is collected in excise taxes, such as those on gasoline. When we add these things in, things become a bit more equal.

However, it's clear that federal taxes still fall disproportionately on the top 20%.

Unfortunately, those aren't the only taxes we pay. More than 40% of our yearly tax bill goes to state and local governments, mostly in the form of sales and property taxes.

When we add together all taxes, we see that "the poor" (the bottom 20%) are the ones paying the highest tax rate.

Wow. This is hard to believe. But the more you think about it, the more it makes sense. The working poor spend the highest share of their income on basic necessities like housing and transportation. This is where property and sales taxes hit the hardest.

When I started researching this, I honestly thought that I would find out that the richest Americans were paying the highest tax rates. After all, we are constantly told that our tax system is progressive, meaning that tax rates rise as income levels rise.

As it turns out, the U.S. tax system isn't progressive. Of all the groups above, the top 1% actually have the 2nd lowest tax rate. The poorest Americans have a tax rate that is 38% higher than the rate paid by the richest Americans.

Wow.

So, the next time someone tells you that 47% of Americans don't pay any taxes, show them this graph:

Sources:

Historical Effective Tax Rates: 1979-2006. Congressional Budget Office.

Additional Data on Sources of Income and High-Income Households. Congressional Budget Office.

Friday, March 25, 2011

"Meteorologist" Fails At Math

Further proof that our political discourse is no longer about facts. It's just about using data to express your opinion:

IPCC Claims 17cm of Sea Level Rise Made the Tsunami Worse

Mr. Watts is clearly an intelligent and apparently well-educated person. But he makes a giant logic error because it fits with his view that climate change is harmless.

Dr. Pachauri at the IPCC notes:

“In the 20th century, sea-level rise was recorded at an average of 17 centimetres. If the sea-level was significantly lower, clearly the same tsunami would have had a less devastating effect.“

Mr. Watts states:

"clearly Dr. Pachauri can’t mentally manage the concept of scale."

He then uses this lovely graphic to show that the size of the tsunami (17m) is much bigger than the sea-level rise (14cm):

And then draws the conclusion that the sea-level raise did not make the tsunami worse at all.

But the logical failure is that something being big and something being small doesn't automatically mean that the small thing doesn't exist.

The sea level rise made the tsunami 1.2% higher. That's not a lot. But it's not "nothing". Using these numbers, we could assume that the sea level rise increased the "devastation" by 1.2%. But that would be understating the effect of the sea level rises.

If a 14-meter tsunami killed 18,000 people, does that mean that a 7-meter tsunami would have killed 9,000 people? It's unlikely. We know that the area was fairly well prepared for a tsunami of about 5 meters -- primarily through a 5.7 meter sea wall built to handle such an event.

So a 3.5-meter tsunami would have caused very little damage. A 7-meter tsunami would have caused more damage, but much of it would have been allayed by defenses in place. The following table seems plausible. It is certainly more plausible than assuming a linear relationship (or, as Mr. Watts would prefer, no relationship):

| Height | "Devastation Units" |

| 3.5 meters | 0 |

| 7 meters | 10 |

| 10.5 meters | 40 |

| 14 meters | 90 |

This is the same effect we see in baseball, where runs scored has an exponential effect on wins. Scoring twice as many runs as an average team will lead to a win-loss ratio that is four times higher.

So, let's assume that a 17 cm (1.2%) increase in the size of the tsunami caused about 3% more "devastation":

The tsunami caused $300 billion in damage. Three percent of that is $9 billion. Nine billion dollars.

The tsunami killed more than 18,000 people. The sea level rise is responsible for more than 500 of these deaths.

I understand that most of the damage was caused by the earthquake. But some of it was attributable to the sea-level rise, including the deaths of more than 500 people. This is in a country with about 500 homicide per year. If Japan managed to completely eliminate all homicides, that would be front page news. But Mr. Watts would like to write off these deaths from sea-level rise as if they never happened.

Sunday, January 16, 2011

Go For Two!

|

| Photo by Keith Allison |

With less than two minutes left in the game, the Patriots scored a touchdown and kicked the extra point, to bring themselves within 7 points of the Jets.

Before the score, the Patriots were down 31-17. It's pretty clear at this point in the game that the only way the Patriots could win is to score two touchdowns while preventing the Jets from scoring.

So, any assessment of the correct strategy should assume that the Pats will score two touchdowns while holding New York scoreless.

The league average success rate for 2-point conversions is 47.9%. Using this rate, it doesn't make sense to "go for 2" if you can tie the game by kicking the extra point. Here's a quick example of how the math works out in that situation (when the trailing team is behind by just 1 point after scoring the touchdown, but before the point-after):

(PAT success is 98.7%):

1) Team scores touchdown to bring score within 1 point. Team kicks extra point.

Chance of leading after this score: 0%.

Chance of being tied after this score: 98.7%.

Chance of trailing after this score: 1.3%.

2) Team scores touchdown to bring score within 1 point. Team goes for two.

Chance of leading after this score: 47.9%.

Chance of being tied after this score: 0%.

Chance of trailing after this score: 52.1%.

A team that ends the game in the lead wins that game. If they end the game trailing on the scoreboard, they lose. All things being equal, a team that ends the game tied has a 50% chance of winning that game.

So, we can award 1.0 wins for a result that puts the team in the lead; 0.5 wins for a result that ties the game; and 0.0 wins for a result after which the scoring team is still trailing.

Using those values, kicking the extra point produces 0.4935 wins but going for two results in only 0.4790 wins.

However, if the trailing team needs *two* touchdowns, the math is totally different.

1) Team trails by 14 points and scores two touchdowns. Team never goes for two:

Chance of leading after both scores: 0%.

Chance of being tied after both scores: 97.42%.

Chance of trailing after both scores: 2.58%.

2) Team trails by 14 points and goes for two after the first touchdown:

Chance of pulling within 6 points: 47.9%.

Chance of pulling within 7 points: 0%.

Chance of pulling within 8 points: 52.1%.

Then, when the team scores a 2nd time, they kick the extra point *if it would give them the lead*. If the team scored 8 points with the first touchdown, they have already tied the game before kicking the extra point.

2a) Team trails by 6 points before the touchdown, and kicks the extra point:

Chance of leading after both scores: 98.7%.

Chance of being tied after both scores: 1.3%.

Chance of trailing after both scores: 0.0%.

If the two-point conversion failed on the first touchdown, the team has to go for two in an attempt to just tie the game:

2b) Team trails by 8 points before the touchdown, and goes for two:

Chance of leading after this score: 0.0%.

Chance of being tied after this score: 47.9%.

Chance of trailing after this score: 52.1%.

To see the overall chance of winning the game with this strategy (going for two after the first touchdown), we have to combine the odds from 2a and 2b:

2) Team trails by 14 points and goes for two after the first touchdown

Chance of leading after both scores: 47.28%.

Chance of being tied after both scores: 25.58%.

Chance of trailing after both scores: 27.14%.

Assuming a 50% chance of winning tie games, here's what we get:

Going for two after the first score: .6007 wins

Kicking the extra point after the first score: .4866 wins

Going for two after the first score increases the chance to win the game by 23.4%. That's a huge difference (and one that Belichick shouldn't have passed up).

The key is that when you know that you need *two* touchdowns, you can make the decision whether to go for 2 on the second touchdown, *already knowing whether you had a successful conversion on the first touchdown*. If you weren't successful, then you need to go for two to tie the game. But if you succeeded on the first touchdown, you can just kick the extra point on the second touchdown, and win the game by 1 point.

Subscribe to:

Comments (Atom)